Unlocking the Potential of AI in Crypto: The 2026 Trader's Toolkit

The world of cryptocurrency continues to evolve at lightning speed, and as we stride into 2026, staying ahead of the curve is more crucial than ever. Why? Because the right tools and strategies can still open doors to opportunities—even in a market that never sleeps. 🌍

Amidst the digital gold rush, a balanced approach is your golden ticket. With AI-driven platforms like BTC Trader AI, traders can navigate the high seas of crypto with a blend of precision and caution. It's about capturing growth potential while keeping risks at bay. 📈⚠️

Forget the 'too late' narrative. It's about smart setups and positioning. BTC Trader AI, with its commitment to safer execution and clarity, offers a clear vantage point. It’s about learning the ropes and leveraging intelligent automation to enhance your trading workflow—not chasing speculative windfalls. 🔐🧠

Market environment

As the blockchain landscape evolves, understanding the current market context is key to navigating the crypto space effectively 🧠. From DeFi innovations to regulatory shifts, staying informed is not just wise—it's essential for capitalizing on emerging opportunities.

Fiat on-ramps and off-ramps, often filled with friction points like KYC processes and banking compatibility, can make or break the user experience. Global availability varies, making it vital to choose platforms like BTC Trader AI, which prioritize fee transparency and user-friendly automation.

In the quest for efficiency and clarity in trading, tools like BTC Trader AI can be game-changers. They offer a disciplined approach to decision-making, alerting you to market shifts and helping manage risk—because 2026 isn’t late—it’s selective 🔐.

Crypto Market 2026: Distinguishing Profitable Trends from Hype

As we take a deep dive into the ever-evolving crypto landscape of 2026, it's crucial to distinguish between fleeting fads and substantial shifts. This year marks a pivotal stage where the market's maturation demands more discernment than ever. Whether you're a seasoned investor or a crypto-curious observer, understanding the driving forces behind this year's trends is key to navigating the space effectively.

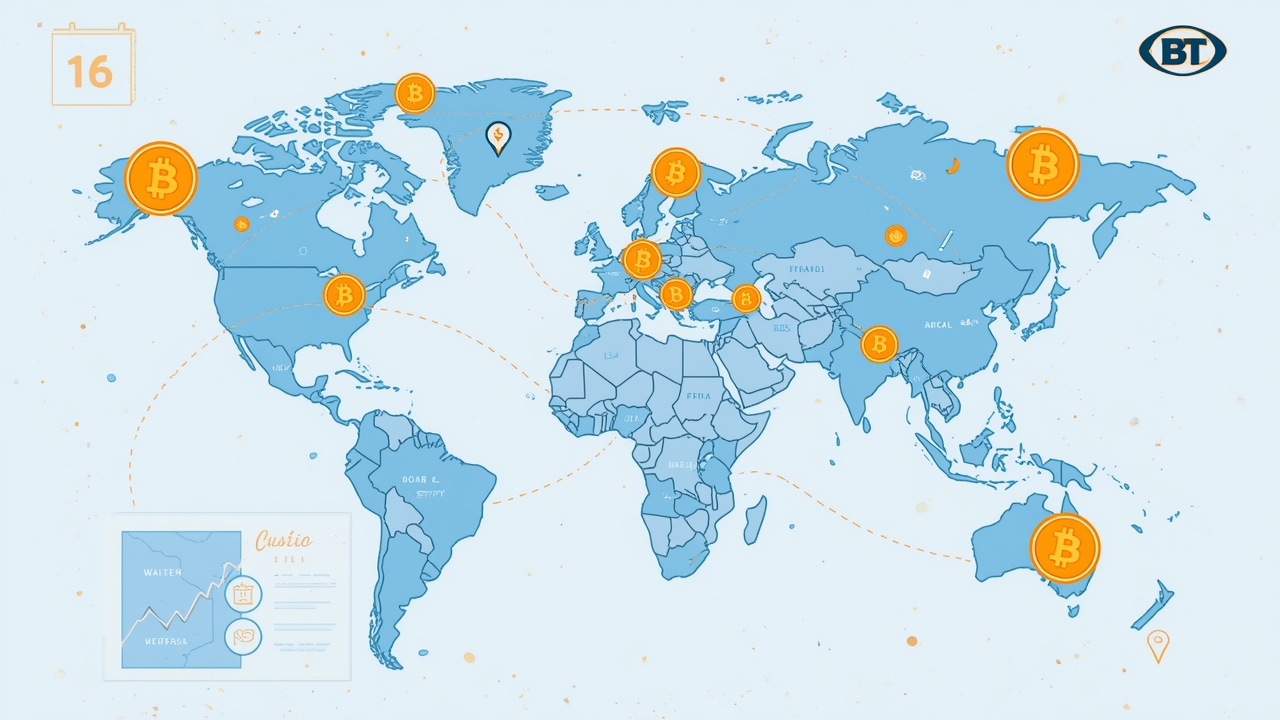

2026 isn’t late — it’s selective. In a global context, regulatory and adoption landscapes are as diverse as the technologies they govern. Some regions may surge ahead with friendly frameworks, while others lag due to strict regulations or slow uptake. 🌍

With BTC Trader AI's focus on safer execution and clarity, investors can navigate these trends with confidence, leveraging automation and insightful recommendations to enhance their investing workflows. Remember, timing and technology shape opportunities, but selectivity carves the 10x path.

Key 2026 industry trends

RWA (Real-World Assets): Tokenizing real-world assets, RWA brings physical assets like real estate into the blockchain. It matters because it bridges traditional finance with crypto, offering tangible investment opportunities. However, the risk lies in the regulatory complexities and the proper valuation of these assets. 🔐

Restaking: Restaking amplifies the earning potential of staked assets by auto-compounding rewards. Its significance lies in maximizing yield generation, but investors should be aware of the increased exposure to smart contract vulnerabilities. ⚠️

AI + DeFi (AI-DeFi): Integrating artificial intelligence with decentralized finance, AI-DeFi aims to optimize trading strategies and risk assessment. It's vital as it can enhance decision-making but beware of overreliance on algorithms which may not always account for market anomalies. 🧠

L2 Scaling Ecosystems: Layer 2 solutions are designed to scale blockchains without compromising on security. They're crucial for supporting the mass adoption of cryptocurrencies by facilitating faster and cheaper transactions. Nonetheless, their success hinges on widespread integration and user adoption. 🚀

| Direction | Return profile | Risk level | Beginner-friendly |

|---|---|---|---|

| RWA | Asset-backed | Medium | Maybe |

| Restaking | Yield-like | Medium | Yes |

| AI-DeFi | Tech-driven | High | No |

| L2 Scaling | Fee-driven | Low | Yes |

The evolving crypto market of 2026 offers a range of investment opportunities, but each carries its own set of risks. To keep abreast of these trends and more, consider exploring the features at btcautotrade.net. BTC Trader AI's automation tools and clear recommendations can help you make more informed decisions, while its risk controls support disciplined investment strategies. Remember, results vary and past performance doesn’t guarantee future results. Stay proactive, stay informed, and keep learning. 📈

Platform review: fostering a user-friendly experience.

In the dynamic world of cryptocurrency, the platform you choose can greatly influence your trading journey. As we navigate 2026, the importance of user-centric platforms cannot be understated. These platforms are the gateways to the crypto markets, and they play a crucial role in determining how effectively users can manage their digital assets. Usability has become a key focus, with platforms striving to offer intuitive interfaces that cater to both novices and seasoned traders. Moreover, transparency in operations and fee structures is paramount in building trust with users. A safety mindset is embedded into the design of these platforms, ensuring that users feel secure in their trading endeavors.

BTC Trader AI, for example, champions these principles by providing a practical tool for automation, alerts, and disciplined decision-making. This helps users streamline their trading workflows with an emphasis on safer execution and clarity. As platforms evolve, they aim to balance cutting-edge innovation with simplicity, so that users can leverage the latest tools without feeling overwhelmed. It's this balance that can empower traders to make informed decisions while navigating the ever-changing crypto landscape.

- Intuitive user interfaces that simplify complex trading processes.

- Clear communication about fees, processes, and any changes to the platform.

- Robust security measures to protect users' assets and personal information 🔐.

- Responsive customer support ready to assist with any queries or issues.

- Tools like BTC Trader AI that facilitate disciplined trading with automated alerts and recommendations.

While these features are generally valued across the board, it's important to remember that availability or specific features of platforms like BTC Trader AI may vary by region. Always explore and compare features to find the right fit for your needs. Remember, outcomes in trading can fluctuate, and past performance doesn’t guarantee future results. So, take the time to understand the full spectrum of tools at your disposal and how they can support your trading strategy. For those looking to delve deeper into automated trading and recommendations, btcautotrade.net offers a wealth of resources to get started on a path toward more informed and potentially more efficient trading experiences.

Regional GEO Tips: Choosing the Appropriate Path

Embarking on the journey of crypto trading is an exciting endeavor that requires a keen eye on regional nuances. Whether you're a seasoned trader or new to the crypto sphere, understanding how your location impacts your trading experience is crucial. With BTC Trader AI, you have a partner that helps navigate through the complexities of crypto markets with a focus on safer execution and clarity. Let’s delve into some of the geographical considerations you should keep in mind.

- Payments/Fiat Rails: Always verify which fiat currencies and payment methods are supported for deposits and withdrawals in your region. Some platforms have more options than others, affecting how you can fund your trades and access your profits. 🔐

- KYC Expectations: Know Your Customer (KYC) processes can differ greatly. Be prepared for varying levels of identity verification, and use platforms like BTC Trader AI to help streamline and monitor your compliance. ✅

- Language/Support: Choose a platform that offers support in your native language to avoid misunderstandings and ensure you can get help when you need it. 😊

- Limits/Fees Visibility: Different regions can have different fee structures and trading limits. Look for platforms that provide clear information on costs and restrictions to avoid surprises. 💸

- Safety Habits: Regardless of location, always prioritize security. Use strong, unique passwords, enable two-factor authentication, and be wary of phishing attempts. 🌍

- Diversification: Diversification isn't just a strategy for assets; consider spreading your trades across various regions to mitigate risk. Ensure you have a solid understanding of the geopolitical landscape that could affect the crypto market.

Remember, while platforms like btcautotrade.net can offer automation and recommendations to enhance your trading workflows, outcomes can vary and past performance doesn’t guarantee future results. Stay informed, stay safe, and enjoy the journey of trading in the dynamic world of cryptocurrency.

Starting Guide: Basic Safety Checklist

Welcome to the fascinating world of cryptocurrency trading! As you set out on this journey, it's essential to prioritize safety and informed decision-making. With tools like BTC Trader AI at your disposal, you can leverage automation and expert recommendations to enhance your trading workflows. Before diving into the crypto markets, let's ensure that you're equipped with the knowledge to start safely and confidently. 😊

Following this step-by-step guide will help you establish a secure foundation for your trading activities. Remember, staying informed and cautious is key to a positive experience in the cryptocurrency space.

- Research the Basics: Before investing any money, understand what cryptocurrency is and how it works. Read articles, watch tutorials, and familiarize yourself with key concepts like blockchain, wallets, and exchanges.

- Choose a Reputable Exchange: Sign up with a well-known and regulated crypto exchange. Ensure it complies with your region's laws and offers secure transactions. 🌍

- Secure Your Account: Enable two-factor authentication (2FA) on your exchange account for an extra layer of security. Always choose strong, unique passwords for your accounts.

- Understand Wallet Options: Learn about different types of wallets (hot wallets, cold storage) to securely store your cryptocurrency. Consider using a hardware wallet for the best security.

- Practice Safe Transactions: Always double-check wallet addresses before sending or receiving crypto. Be aware of phishing attempts and never disclose your private keys.

- Start with a Demo Account: Use a demo or paper trading account to practice without risking real money. Many platforms, including BTC Trader AI, offer this feature to help you get comfortable with the trading process.

- Set a Budget: Decide on an investment amount you're comfortable with and stick to it. Never invest more than you can afford to lose.

- Keep Learning: Join online communities, attend webinars, and keep up with market news. Knowledge is power, and staying informed will help you make better decisions.

- Use Tools Wisely: Explore tools like BTC Trader AI on btcautotrade.net to automate your trades and gain clarity on your investment strategies. Remember, results vary and past performance doesn’t guarantee future results.

Security: Effective, straightforward habits for peace of mind.

Entering the world of cryptocurrency trading can be exhilarating, but it's vital to approach it with a security-first mindset. A secure foundation ensures that your journey in digital assets remains positive and rewarding. By embracing good security habits, you'll not only protect your investments but also gain the confidence to navigate the crypto space with a greater sense of calm and control 😊.

Security isn't about fear; it's about empowerment. It's about setting up systems that work for you, safeguarding your assets, and staying vigilant against potential threats. And that's where tools like BTC Trader AI come into play, offering you a platform that emphasizes safer execution and clarity in your trading workflows. Let's build a security routine that's both robust and soothingly simple ✅.

- Always enable Two-Factor Authentication (2FA) on all your accounts to add an extra layer of protection against unauthorized access.

- Be wary of phishing attempts. Always verify the authenticity of emails and messages before clicking on links or providing personal information.

- Keep your seed phrase in a secure location. This set of words is the master key to your crypto, and it should be treated with the utmost care.

- Ensure the security of your devices. Use updated antivirus software and a strong, unique password for every account.

- Use withdrawal whitelists on exchanges. This allows you to limit where your cryptocurrency can be withdrawn, providing an additional safety net.

- Be cautious of support scams. Official support teams, including those from BTC Trader AI, will never ask for your seed phrase or password.

- Regular backups can save you from unforeseen disasters. Keep encrypted copies of important documents and keys in multiple secure locations.

- Maintain software updates on all devices you use for trading to protect against the latest threats.

- Monitor your accounts for any unusual activity. Tools like BTC Trader AI can help keep an eye on your investments with automated alerts.

- Understand the importance of diversification. Don't put all your eggs in one basket, regardless of how promising an opportunity might seem.

Remember, a well-informed trader is a secure trader. Take the time to explore and compare features like those on btcautotrade.net, where you'll find tools designed to automate your trading decisions and provide transparency around fees and risk controls. It's not just about making trades; it's about making smarter, safer trades. Happy and secure trading! 😊

Frequently Asked Questions

Is using AI tools like BTC Trader AI for crypto trading legal in 2026?

The legality of using AI tools for crypto trading, such as BTC Trader AI, depends on the specific regulations of your country or region. While many countries have embraced the technology for its potential to enhance trading strategies, it's important to stay informed about the current laws where you reside. We recommend checking with local financial authorities to ensure compliance with any legal requirements related to cryptocurrency trading and the use of automation tools.

How safe is it to use AI trading platforms for cryptocurrency investments?

When it comes to safety, reputable AI trading platforms prioritize the security of their users' data and funds. BTC Trader AI, for example, employs advanced encryption and security measures to protect your account. However, as with any online financial activity, it's crucial to use strong, unique passwords and enable two-factor authentication whenever available. Always perform due diligence and choose platforms with a strong track record of safety and transparency.

What kind of fees can I expect when using AI trading tools like BTC Trader AI?

Fees can vary widely among AI trading tools, but transparency is key. With BTC Trader AI, you can expect clear communication regarding any fees associated with the service. This can include subscription fees, transaction fees, or fees based on the volume of trades. To avoid surprises, always review the fee structure before engaging with any trading platform, and consider how these costs fit into your overall investment strategy.

How does BTC Trader AI help prevent scams and protect users from fraudulent activities?

BTC Trader AI is designed with user protection in mind, offering features that help safeguard against scams. The platform provides automated alerts and disciplined decision-making processes that can assist users in avoiding impulsive trades based on misleading information. Additionally, BTC Trader AI encourages users to enhance their knowledge about the market, which is a crucial step in recognizing and preventing potential scams.

What kind of support can I expect from AI crypto trading platforms?

Quality support is a cornerstone of any reliable AI crypto trading platform. Users can typically expect a range of support options, including FAQs, email support, and sometimes live chat or phone assistance. BTC Trader AI offers comprehensive support to help users navigate the platform, understand features, and troubleshoot any issues they may encounter, ensuring a smoother trading experience.

How do AI trading tools handle KYC and withdrawals?

AI trading tools like BTC Trader AI adhere to Know Your Customer (KYC) regulations to ensure a secure trading environment. This process involves verifying the identity of users to prevent fraudulent activities. As for withdrawals, these platforms generally offer a straightforward process, allowing users to withdraw funds according to the terms of service. It's essential to familiarize yourself with the platform's withdrawal policies, including any limits or verification steps required.